Adopting the mindset of a CFO

You’ve likely heard the term “CFO,” or “Chief Financial Officer,” but what exactly does a CFO do, and what attributes can you apply to your own personal financial life?

A CFO’s primary responsibility is to design a company’s balance sheet, making strategic decisions regarding liquidity and liability management. This involves determining the appropriate amount of debt and how to manage it over time. Too much debt increases risk, while too little can make investors uneasy and leave the company vulnerable to a leveraged buyout.

DEVELOPING A PERSONAL DEBT PHILOSOPHY

Just as a CFO must have a strategic approach to managing debt – you can benefit from adopting a similar mindset. Here are some key concepts to consider:

LIQUIDITY, LIQUIDITY, LIQUIDITY

Liquidity refers to readily accessible money in the bank or through liquid investments. Owning a debt-free, million-dollar home might offer confidence but provides limited liquidity. In contrast, a $1 million portfolio could possibly offer significant flexibility and financial freedom. The ability to access cash quickly can be more valuable than simply having no debt.

Companies maintain liquidity through lines of credit, and you can consider similar arrangements. Establishing a line of credit can provide you with the liquidity needed for emergencies or investment opportunities.

STRATEGIC DEBT MANAGEMENT

CFOs distinguish between low-cost debt and high-cost debt. Low- cost debt, such as a mortgage, can be a valuable financial tool, allowing you to leverage your investments and potentially achieve higher returns. High-cost debt, such as credit card debt, should be avoided or paid off as quickly as possible. The key is to be thoughtful and strategic, understanding the nuances of different types of debt and their implications on your financial health.

TAX EFFICIENCY

The decisions we make with debt can have a ranging, material impact on taxes. A CFO understands the tax implications of every decision, which is crucial for making informed choices. By understanding how debt affects your tax situation, you can make more strategic decisions that optimize your overall financial position.

MAKING INFORMED DEBT DECISIONS

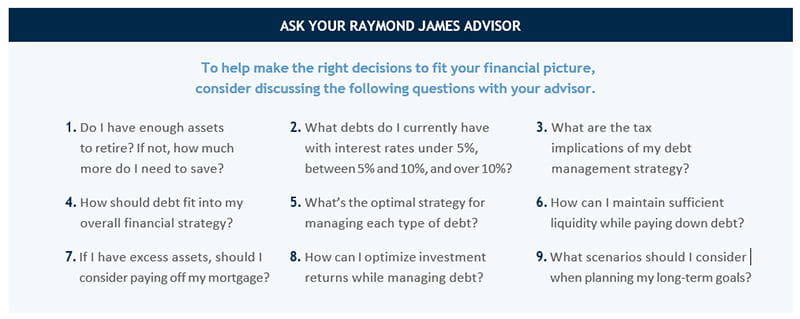

The decisions you make regarding debt are among the most important in your financial life. These decisions should not be made lightly or based on guesswork. Just as a CFO relies on careful analysis and strategic planning, you should work with a Raymond James advisor to run the numbers and perform a critical analysis of your financial situation. This approach ensures that your debt decisions align with your long-term financial goals and risk tolerance.

CFOs seek optimization and knowledge, thinking strategically about every aspect of their financial responsibilities. By applying the same principles to your personal finances – valuing liquidity, managing debt strategically, and understanding tax implications – you can help achieve a more stable and flexible financial future. Work with your Raymond James advisor to develop a plan that incorporates these strategies, empowering you to make decisions with confidence and clarity.

This content was created by Tom Anderson, founder of Supernova Companies and CEO of Anasova, for Raymond James Bank. Raymond James is not affiliated with Tom Anderson, Supernova Companies or Anasova. Any opinions are those of Tom Anderson and not necessarily those of Raymond James.

Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and investors may incur a profit or a loss. Raymond James & Associates, Inc., and Raymond James Financial Services, Inc. do not provide advice on mortgages. Raymond James and its advisors do not offer tax advice. You should discuss any tax matters with the appropriate professional. Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.